Accounting ERP

Benefits of SeniorERP for Accounting:

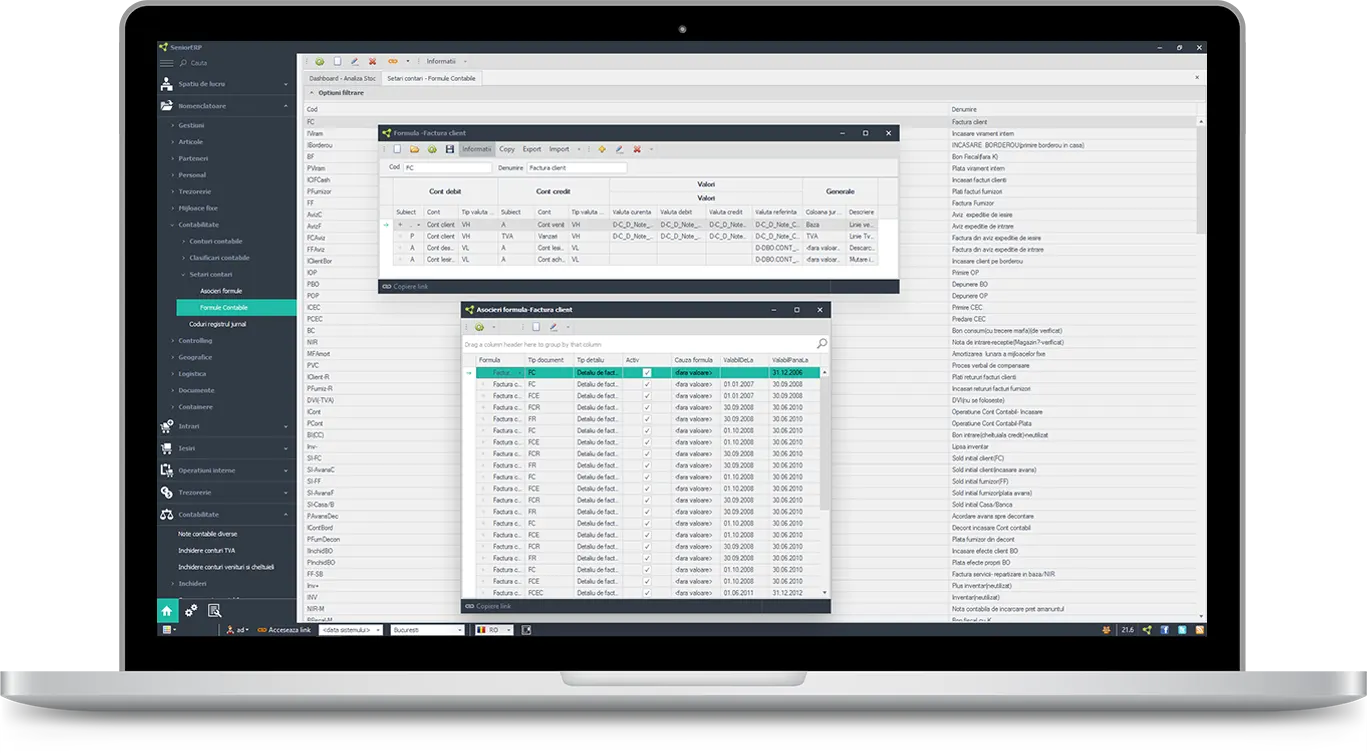

Accounting ERP: Accounting formulas

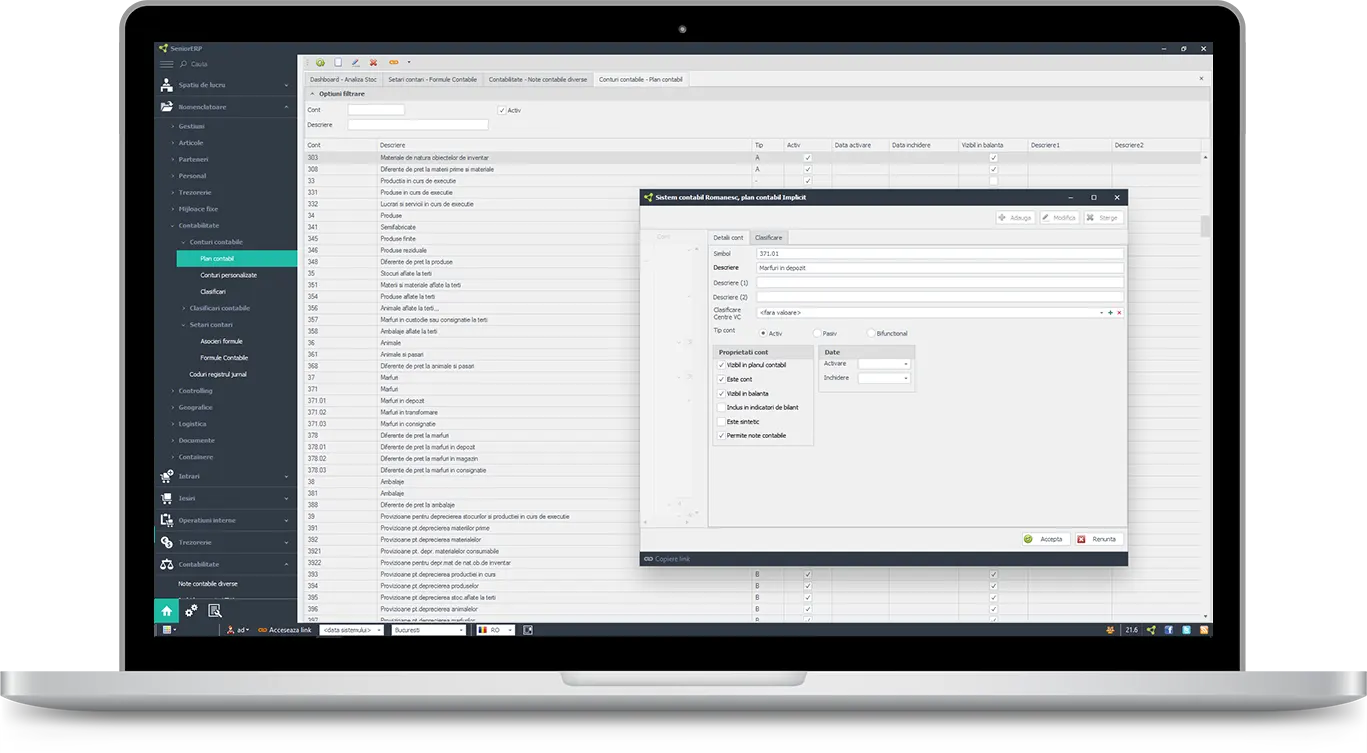

In SeniorERP the account plan follows current legislation and it is presented in an extremely intuitive way. Thank to an efficient way of structuring generated accounting records, there is no need for a large amount of analytical accounts.

Thus, the account plan is kept with an accessible structure, without affecting the ability to detail accounting statements by component sums and sources.

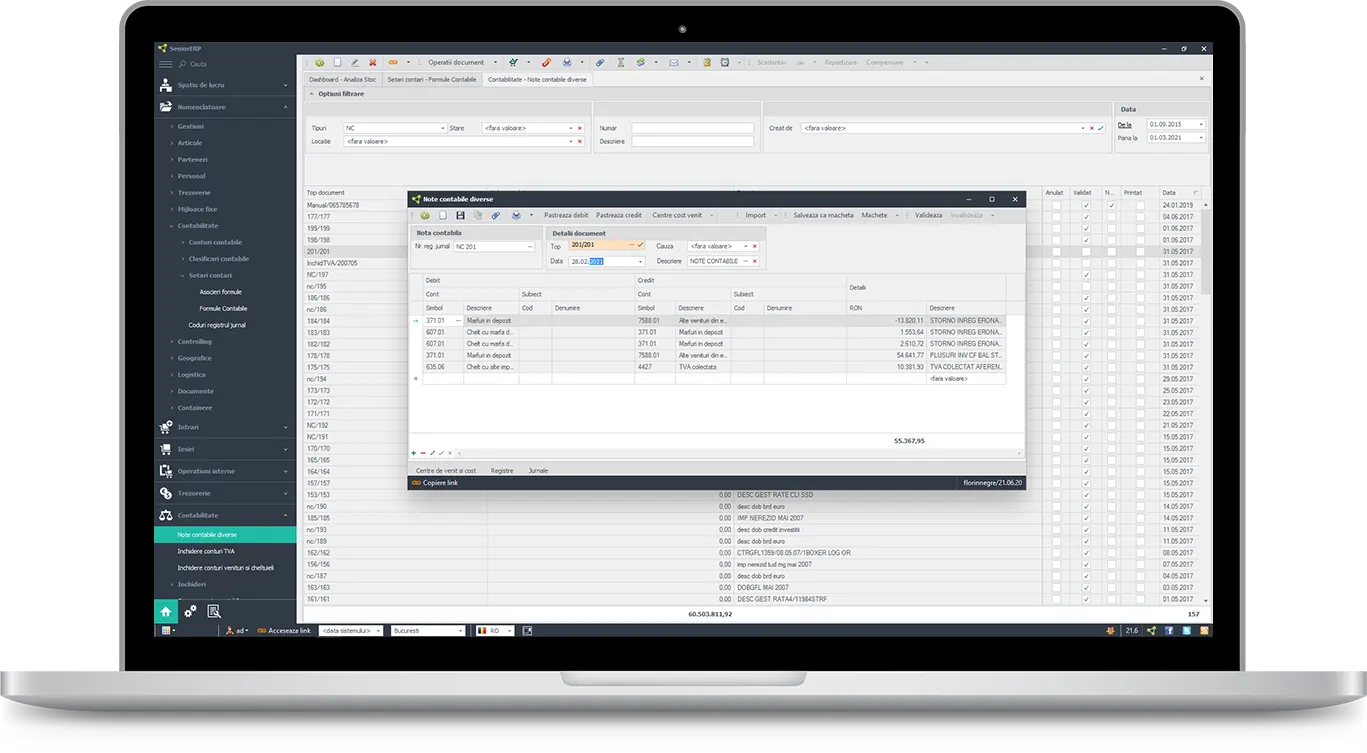

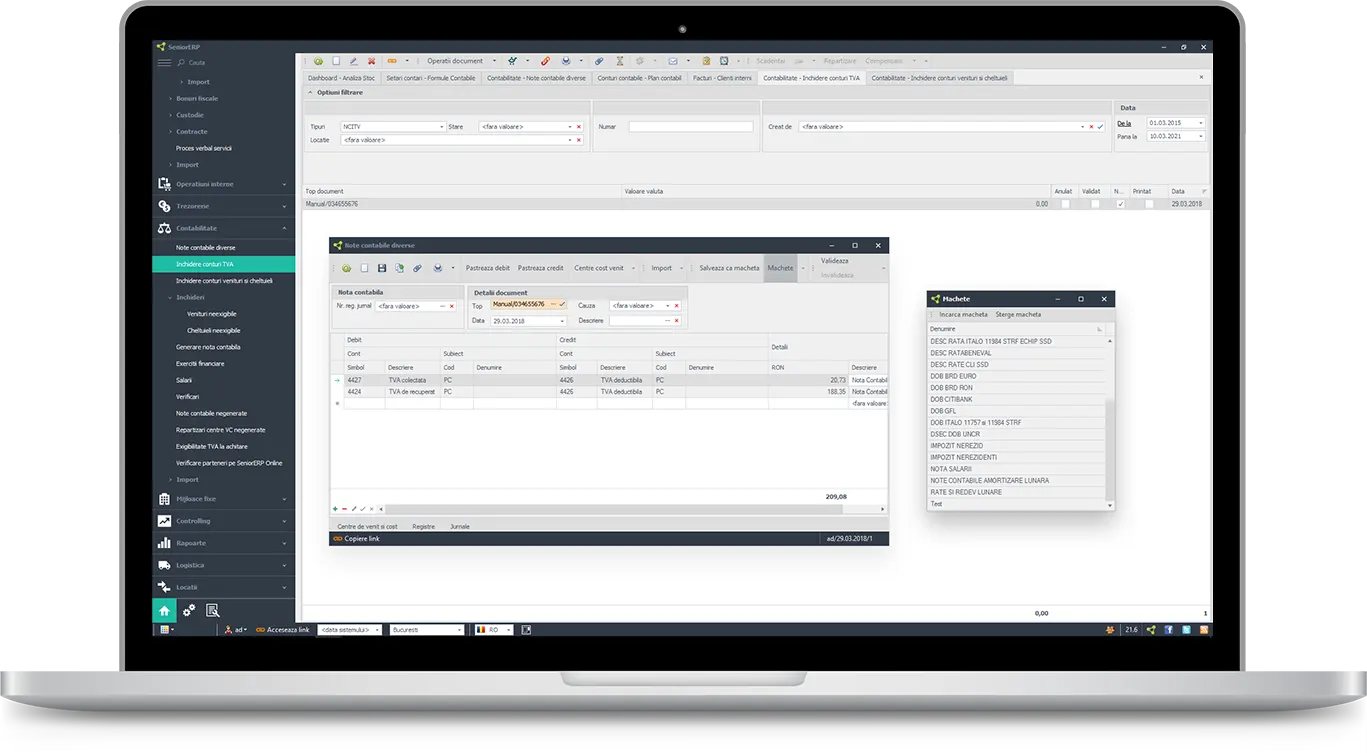

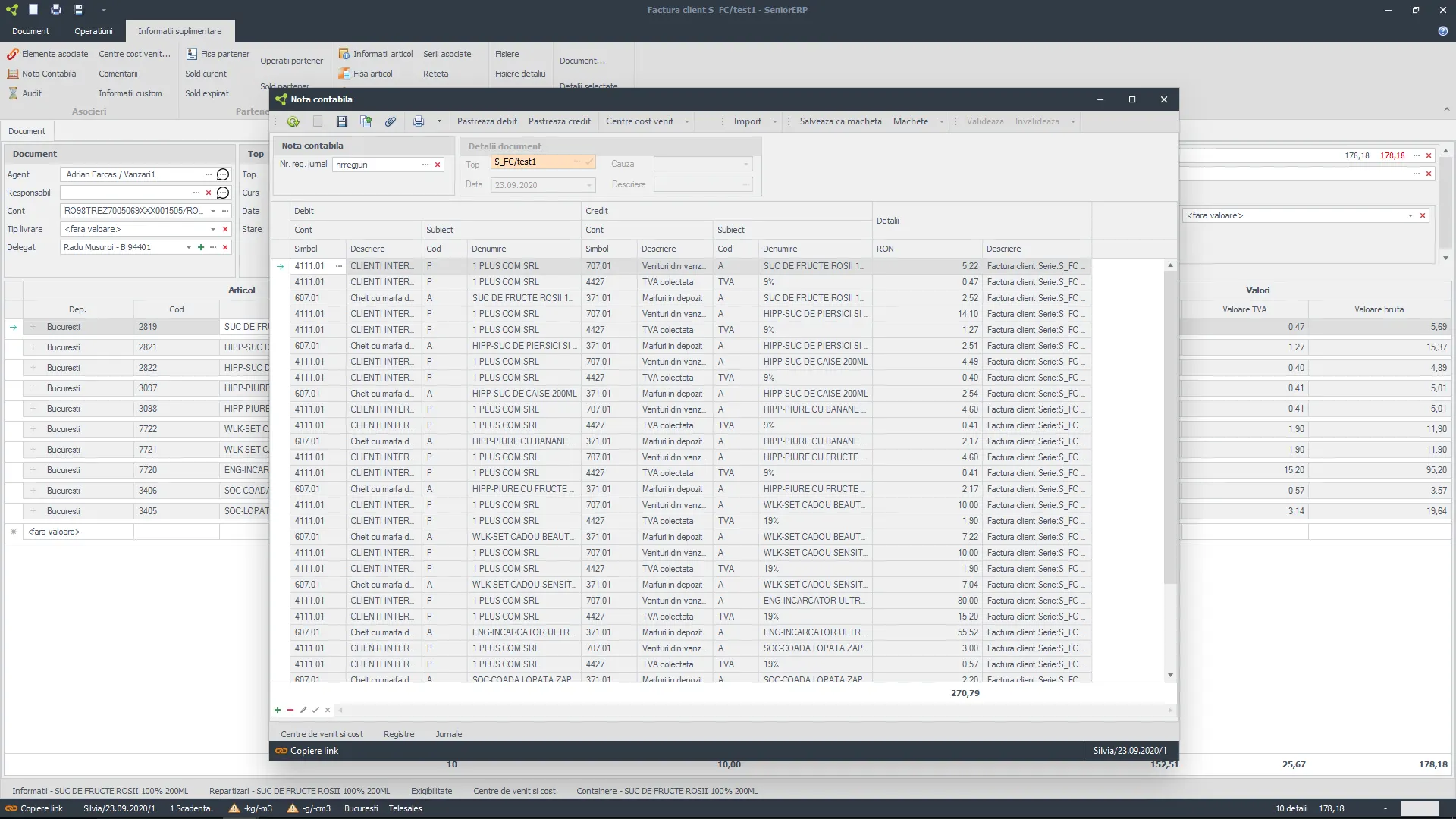

Accounting ERP: Various accounting notes

In SeniorERP there can be easily defined accounting formulas which can later be associated to documents or operations made within the ERP system.

With their help, accounting notes can be generated automatically, correct and with minimum intervention from users. Additionally, changes made in accounting notes can be made any time they are needed, based on user rights set up by the system admin.

Accounting ERP: Accounting plan

After implemention the ERP system, a large percentage of accounting records will be generated automatically, according to the requested settings.

In exceptional cases, creating corrective accounting nates is necessary, or in the case when not all of the app’s components have been purchased, the manual operation of the specific notes.

Even the introduction of these various accounting notes can be easily done, according to templates that are easy to define, so that only the sums will need to be written.

Accounting ERP: Accounting notes

Even though accounting notes are generated when users operate with a document in the ERP, if after the generation specific parameters are changed, the need to collectively regenerate the specific accounting notes arises.

From here you can also globally validate or cancel documents, with the possibility to select operation types and desired periods.

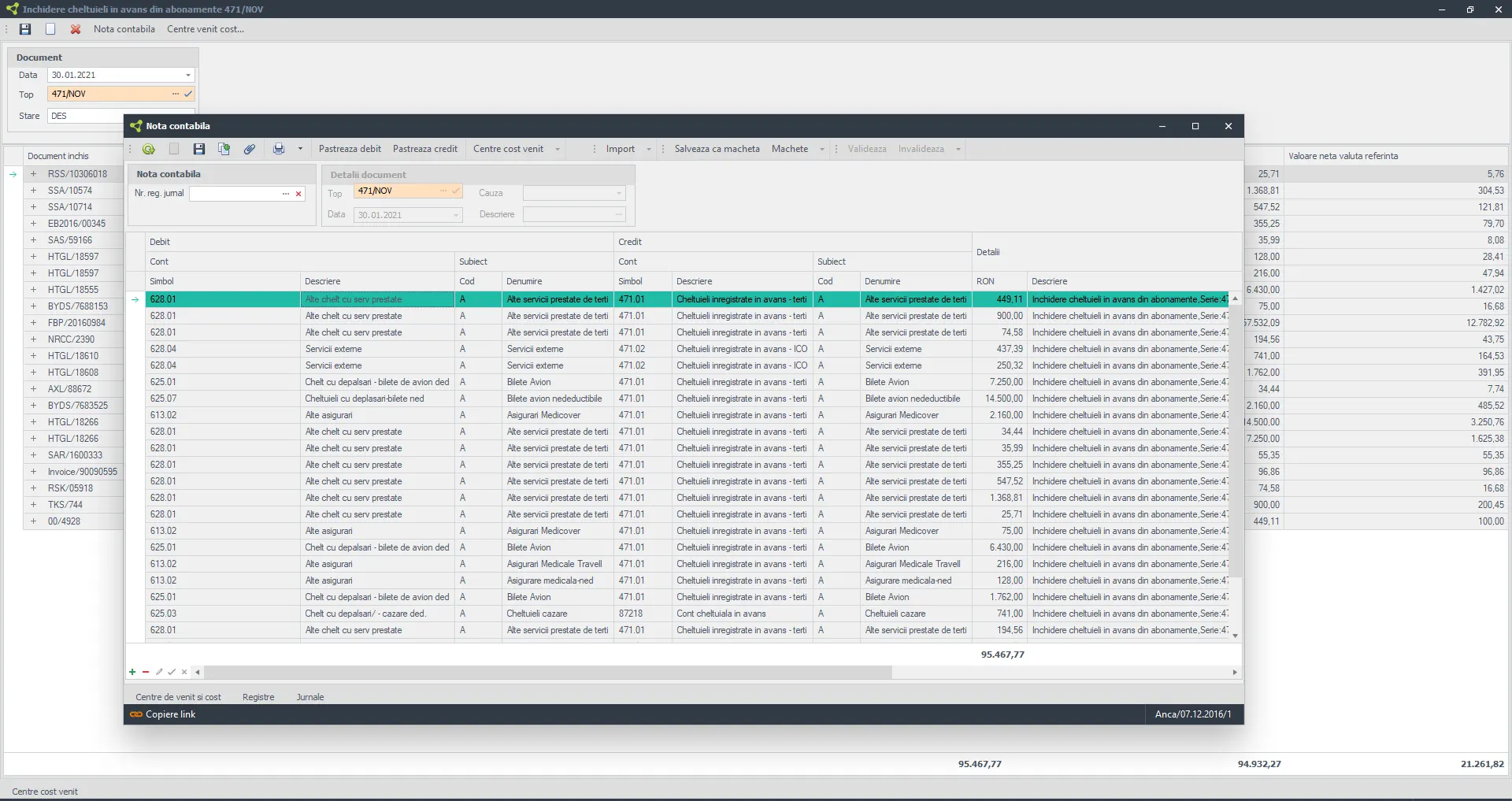

Accounting ERP: Closing of ineligibile income and expenditures

For example, when it comes to selling subscriptions in advance, monthly, a part of these incomes and the related ineligible VAT become effective and eligibile. With the help of this ERP functionality, you can decie which incomes and expenditures become effective in the selected month and you can adjust the appropriate VAT, procedures which can be done automatically or manually.

It is very important that when a legislative change occurs, if all accounting nates prior to the change are regenerated, they will respect the settings available at that respective date, any changes brought becoming active only in the desired moment.

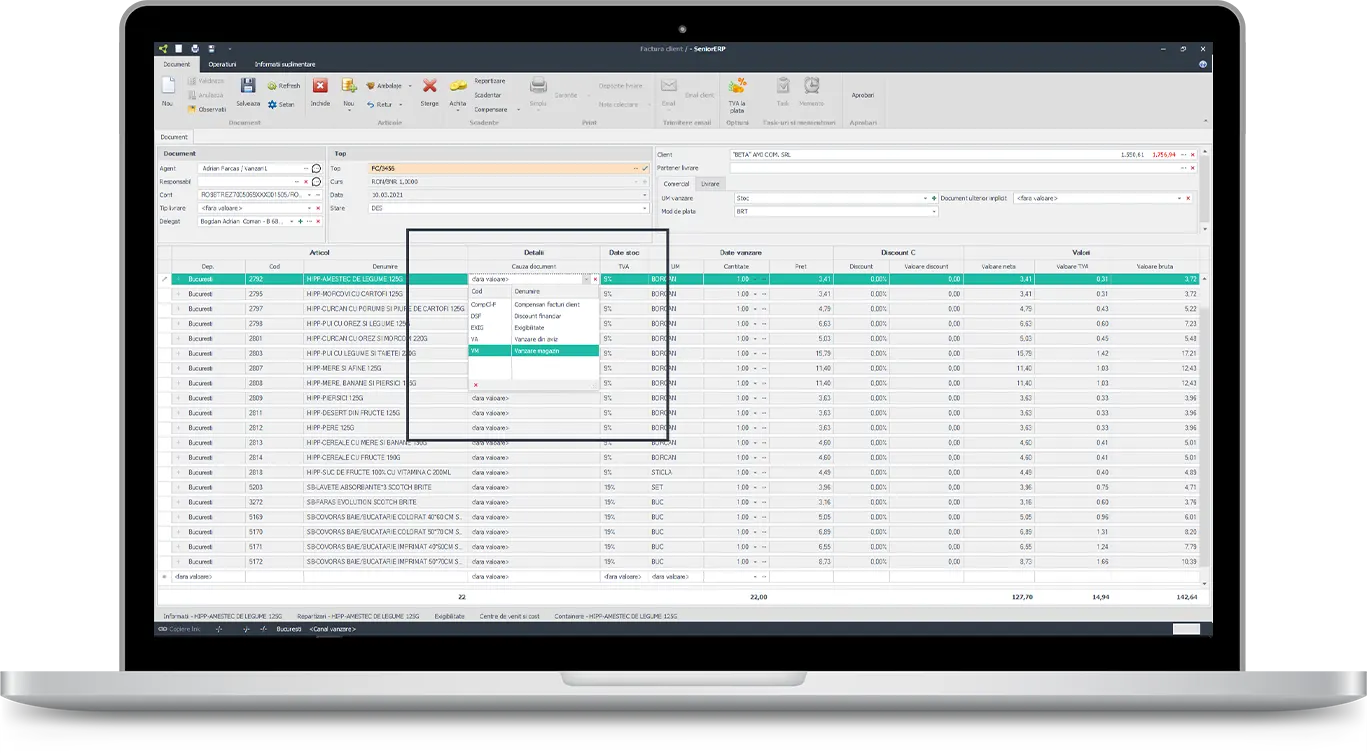

ERP: Causes on documents

There are situations when a primary document (ex.: consumption or inventory notes) can generate different accounting notes, based on the context from which they were released (ex.: protocol, depreciation, composition etc).

The engine which generates accounting entries in SeniorERP guarantees a very simple method of associationg accounting notes to documents, by the selectable causes (which can be defined by case) which lead to the release of that specific document.

Accounting ERP: Accounting operations

These operations mainly cover operations specific to closing operations from an accounting month. For example: closing VAT, closing Income & Expenditures etc. It is recommended that these actions are made after end of the month checkups have been made.

If, for example, a closing of income & expenditures has been made and it has been noted that an entry has not been operated, the operation can be redone after introducing that document. Also, after these operations have been made and checked, it is recommended to end the accounting exercise (month), to be sure that the data cannot be modified again.

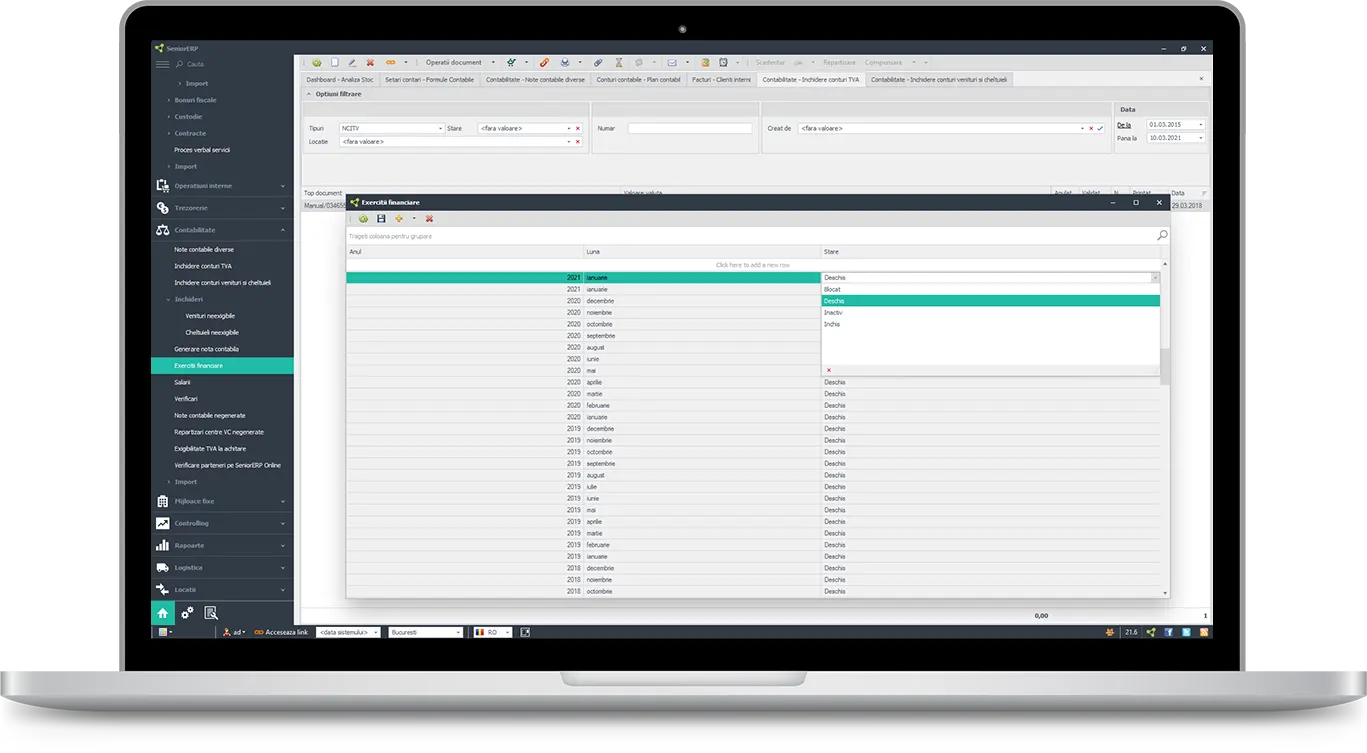

Accounting ERP: Financial years

The accounting process of closing an operational month implies extensive check-ups by the accounting department. During implementations we’ve identified various types of check-ups and we have automated them. These, along with the ability to create, validate, close or reopen an operational month, make the object of this functionality.

The ERP system makes possible the operation of financial exercises both in the previous month as well as for more months simultaneously, the only condition being that they are not closed.

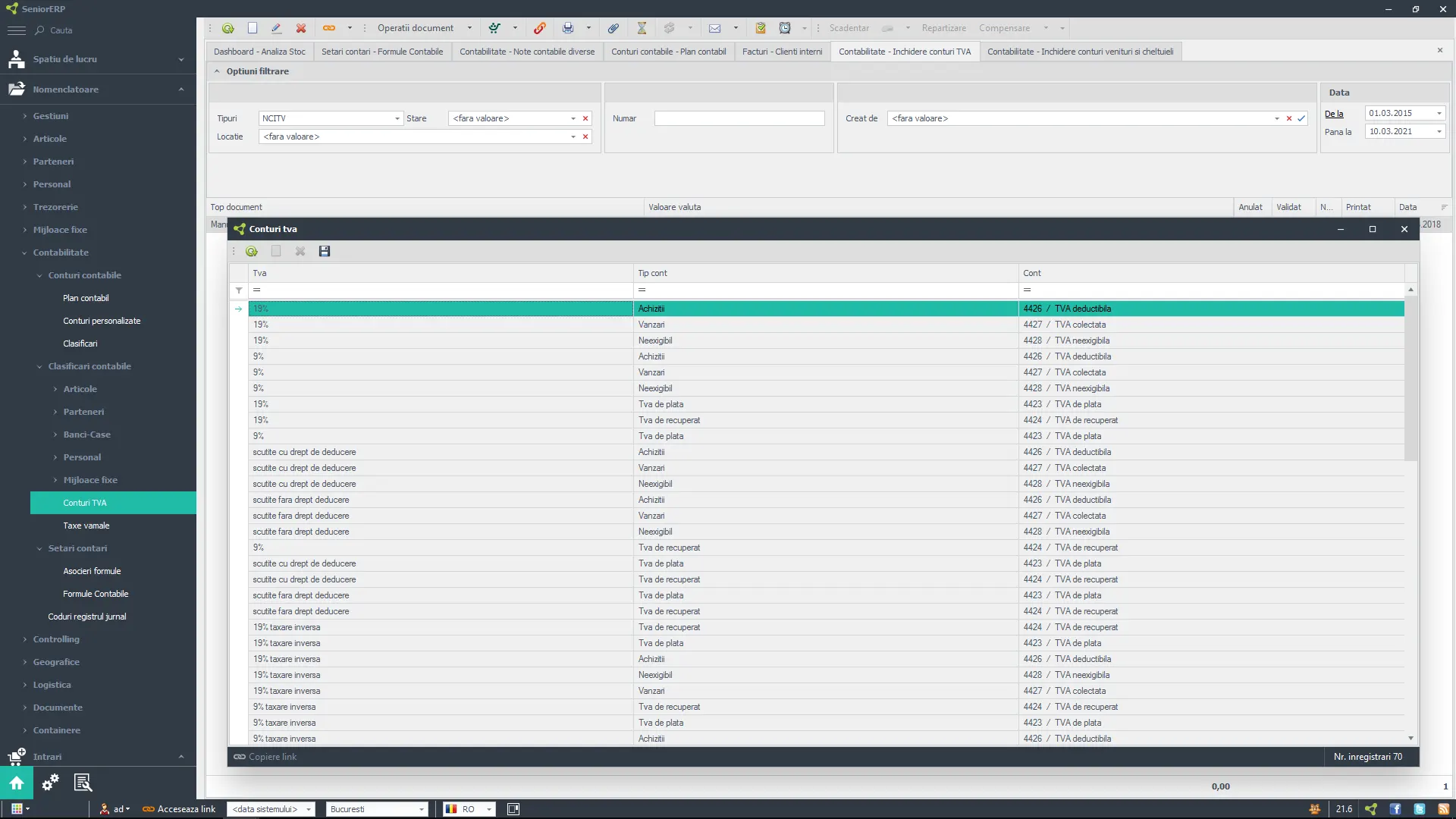

Accounting ERP: VAT

In SeniorERP you can easily configure all VAT rates related to all goods and services offered by your company.

The system even supports the VAT cash accounting scenario and allows the closing in due time of VAT accounts, regardless if we’re talking about monthly closes or trimestral ones.

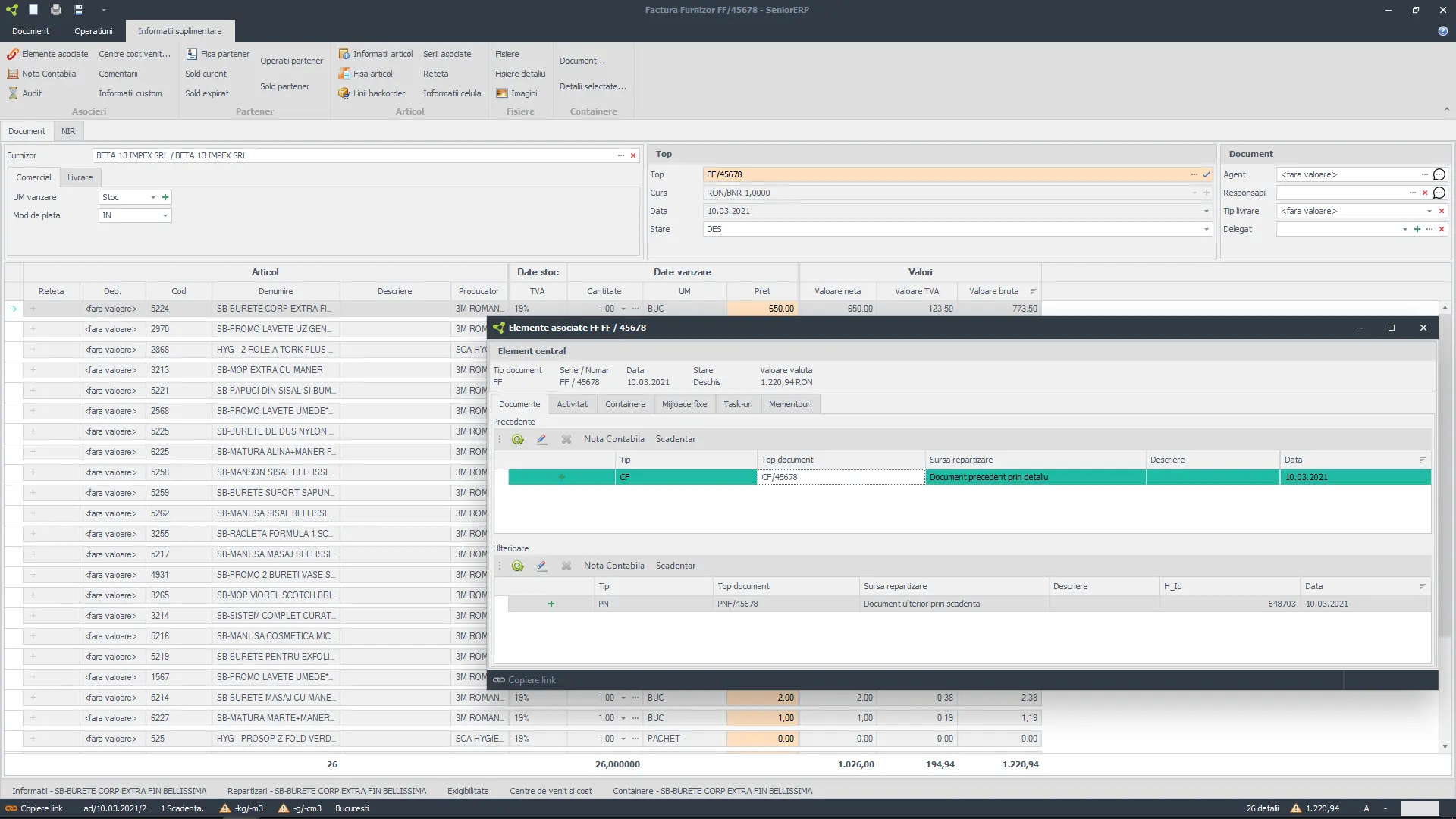

Accounting ERP: Associated documents

SeniorERP allows you to visualize previous and following repartitions for most finalized documents from the system: orders, notes, invoices etc.

They can be viewed and accessed from the “Associated Elements” form, which in turn is accessible from the button with the same name, found in the said document.

Romanian

Romanian English

English